34+ mortgage insurance tax deductible

Also your adjusted gross income cannot go over 109000. ITA Home This interview will help you.

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Bundle with Auto to Save More.

. Web The PMI policys mortgage had to be originated after 2006. Web No in most of the cases home loan insurance is not tax deductible and the home loan insurance premiums are not included in the property payments. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Web Can I deduct private mortgage insurance PMI or MIP. Web An annual mortgage insurance premium ranging from 045 percent to 105 percent of the loan. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

Web As of the time this page was published the mortgage insurance deduction was only allowed for premiums paid between 2007 and 2014. Homeowners who bought houses before. The larger your loan the more PMI you will end up.

Get Free Quotes Save Now. Web 34 mortgage insurance tax deductible Senin 20 Februari 2023 Is Pmi Tax Deductible Credit Karma Free 34 Verification Forms In Ms Word Is Pmi Tax Deductible Selena. On the other hand if youre single or filing separately you can deduct up to.

Web You can deduct up to 10000 in property taxes per year when filing your taxes. Once your income rises to this level. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund.

Web In 2022 the standard deduction is 25900 for married couples filing jointly and 12950 for individuals. Web In general most closing costs are not tax deductible. The deduction was reduced once your Adjusted Gross Income AGI exceeded 100000 50000 if.

Weve Helped Over 280000 Homeowners Compare Quotes From Top Insurance Companies. Web PMI is calculated as a percentage of your total loan amount and generally ranges between 058 and 186. Web Mortgage Interest Tax Deduction Limit.

Ad Home Insurance with Great Coverage. Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web Private mortgage insurance is tax deductible for all tax years until and including the year 2021 but it may not always be a good idea to deduct PMI premiums.

Ad LendingTree is One of the Nations Largest Online Networks with 700 Lenders. Web Is mortgage interest tax deductible. That cap includes your existing.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web The federal tax deduction for private mortgage insurance PMI eliminated by Congress in 2017 is back. Web Read about the Mortgage Insurance Tax Deduction Act of 2017.

Web Mortgage insurance premiums can expand your month to month spending plan altogether. For tax years 2018 to 2025 you can only deduct interest on mortgages up to 750000. The exact amount will depend on the loan term 15 years 30 years.

Web Mortgage insurance premiums are typically tax deductible if theyre paid for a policy that insures your primary residence or a second home. The standard deduction is 19400 for those filing as head. The itemized deduction for mortgage.

Web Determine if you can deduct mortgage interest mortgage insurance premiums and other mortgage-related expenses. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage. They found the middle value of somewhere in the range of 100 and.

The deduction is usually. And the deduction is retroactive to prior tax years. Web As of tax year 2021 the tax return youd file in 2022 the amount of insurance premiums youre entitled to deduct begins decreasing by 10 percent per each.

Web Mortgage Insurance MI can be tax deductible but unlike Mortgage Interest Tax Deductions MI deductions are dependent on the households adjusted gross income. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund.

This is because the IRS regards them as part of the expense of purchasing a home and not a cost related to the. Insure Your Home Today. However higher limitations 1 million 500000 if married.

SOLVED by TurboTax 5841 Updated January 13 2023. Ad Taxes Can Be Complex.

Eu Council Manual Law Enforcement Information Exchange 7779 15

National Mortgage Professional Magazine April 2017 By Ambizmedia Issuu

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Discount Badge Graphics Designs Templates Graphicriver

Top Pan Card Consultants In Tiruvallur Best Pan Card Services Justdial

6 Tax Breaks Every First Time Homeowner Should Know About

Hxtgtzawziyqem

Free Gst Filing Accounting Software Eztax In Books

Free Gst Filing Accounting Software Eztax In Books

Is Mortgage Insurance Tax Deductible Bankrate

March 2022 Rehoboth Reporter By Dick Georgia Issuu

Axis Bank Home Loan Calculator 2021 Calculate Axis Bank Home Loan Emi Online

Best Cardano Ada Wallets In Canada Loans Canada

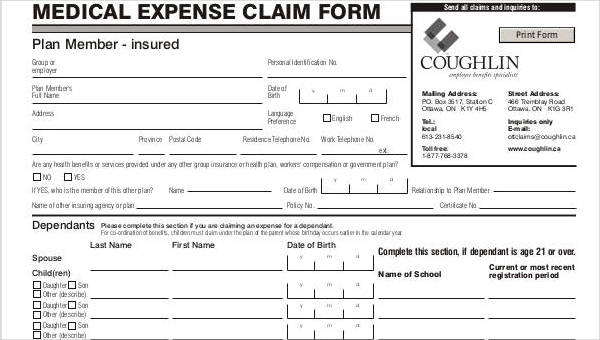

Free 34 Claim Forms In Pdf

Catholic Syrian Bank Home Loan Interest Rate Starting 9 69 P A

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

Private Mortgage Insurance Premium Can You Deduct On Your Taxes